VisitBritain upgrades 2023 inbound tourism forecast on back of stronger recovery, driven by USA

Photo by: VisitBritain/Adam Jason

Location: Whitstable, England

Intro

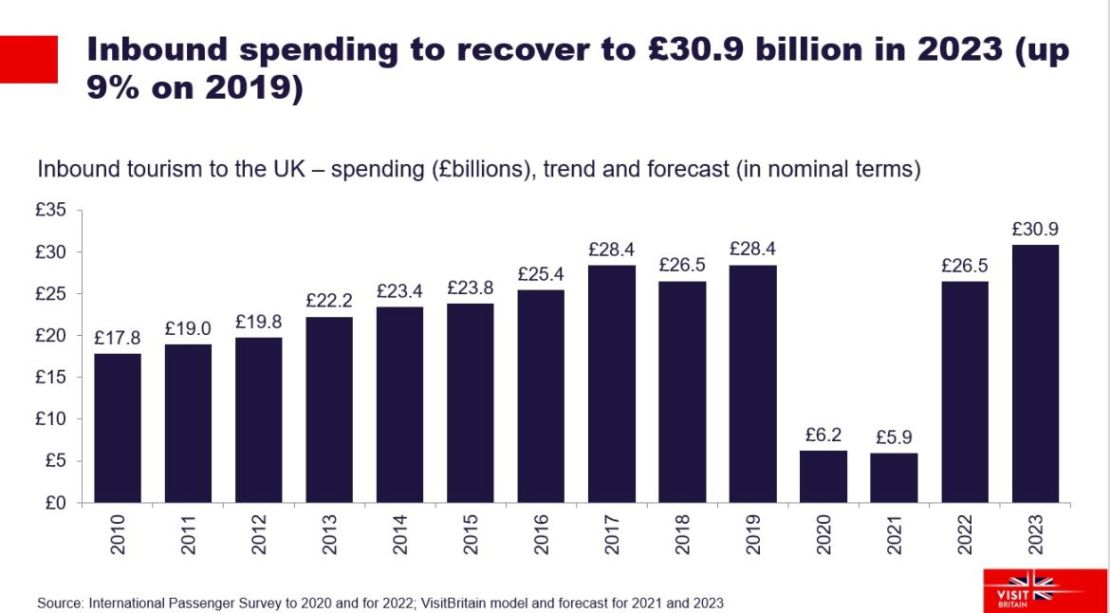

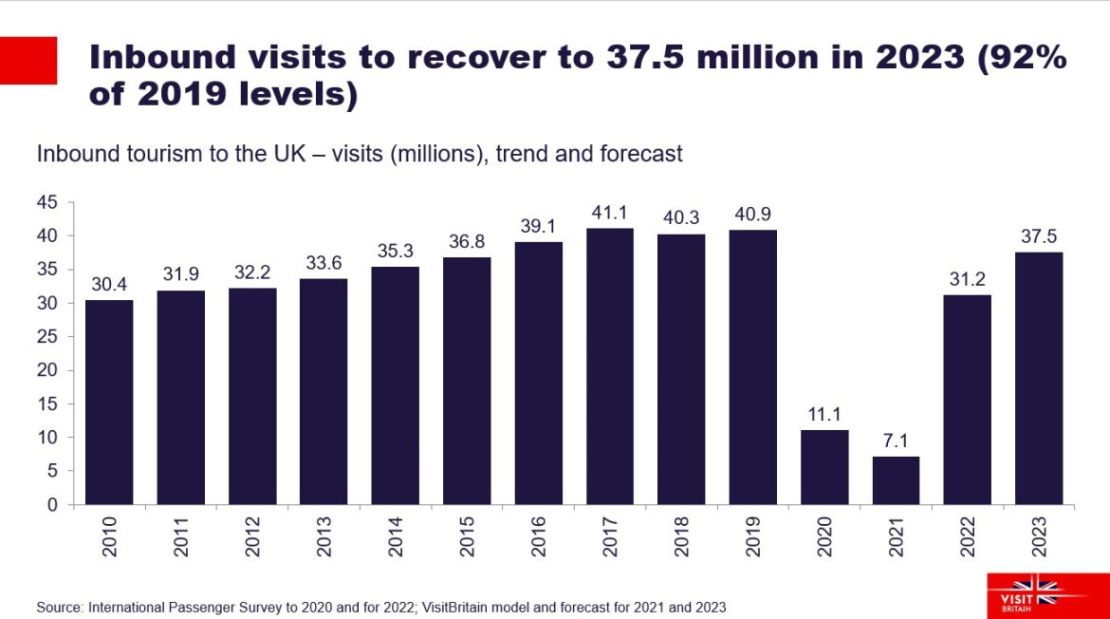

We’ve upgraded our 2023 inbound tourism forecast. Visits overall to the UK this year are now forecast to be 37.5 million, 92% of 2019 levels and inbound visitor spending £30.9 billion, up 9%. See the statement from our CEO Patricia Yates below and the full revised forecast here.

VisitBritain CEO Patricia Yates said:

“Our upgraded forecast is on the back of the stronger recovery we’re seeing, led by the USA with spending by American visitors up 42% to a record £6 billion last year alone. Spending by visitors from our major European markets including France and Spain is also coming back strongly, while East Asia including China, our second most valuable inbound market in 2019 worth £1.7 billion, is still well below pre-COVID levels.

“Our priority has been to rebuild visitor value and we’ve been competing hard in markets showing strong recovery with our multi-million pound GREAT Britain marketing campaigns and working with trade so British destinations are sold internationally. We’ve also been investing in separate campaigns in the USA with British Airways and a pilot cooperative marketing programme with industry, converting the interest to visit into bookings now, boosting spend across Britain.”

Photo by: VisitBritain

Photo by: VisitBritain