2025 inbound tourism forecast

section 1

Summary

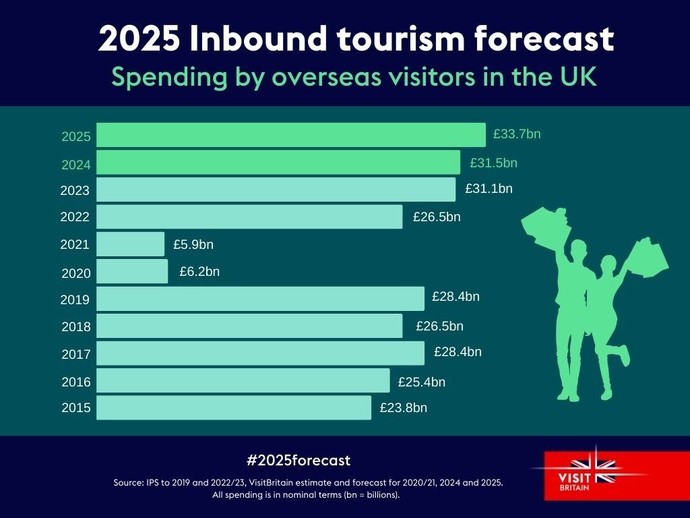

- 2024: VisitBritain’s estimate for the full year 2024 is 41.2 million inbound visits to the UK with £31.5 billion spent. If realised, this would set a record for both measures, edging out 2017’s 41.1m visits and 2023’s £31.1bn.

- This would represent growth of 9% in visits on 2023, and would be 1% up on 2019. Spend would be 1% up on 2023 (though 1% down in real terms) and 11% up in nominal terms on 2019.

- 2025: VisitBritain forecasts 43.4 million visits and £33.7 billion spend.

- Compared to 2024, this is growth of 5% in visits and 7% in nominal spend (4% in real spend). This would be 106% and 118% of the 2019 levels respectively, although spend is 93% of the 2019 level when you adjust for inflation.

- This is the central forecast. Risks are judged to be to the downside.

Photo by: VisitBritain

Further information about the forecast

Recent patterns in visit volumes: Official data from the International Passenger Survey (IPS) is available to June. This shows 19.5m visits, up 11% on 2023 and up 4% on 2019. Spending was down 1% on 2023, up 15% on 2019 in nominal terms but down in real terms. Home Office data on arrivals from non-UK nationals indicate that inbound tourism volumes grew in the third quarter of the year but at a slower pace. Data from other sources suggest that growth was a little slower in the second half of the year than in the first half.

Markets, journey purposes and nations/regions: Visits to Friends or Relatives (VFR) lead the recovery, with trips and spend tracking well above pre-COVID and showing continued growth. Holiday visits have almost reached pre-COVID levels and are growing, although spend is down in real terms. Business visits are lagging well behind (both short and long haul) though up on 2023; the UK has lost c.1.5m business visits since pre-COVID. Much of this decline has been in routine business trips; MICE visits have not declined as much. Looking across data sources indicates that European and long-haul markets have recovered at similar rates in the aggregate when compared to 2019, with wide variation in the latter (East Asia still slow; North America, Australia and Saudi Arabia delivering strong numbers). In 2024 itself, Europe is estimated to have seen higher growth year-on-year than for long haul markets, which had seen a stronger 2023. In the 2025 forecast, visits from European markets are forecast to grow by 4% and from long haul markets by 7%. All nations and both London/Rest of England saw growth in 2024 data available to date; compared to 2019, Scotland is leading the recovery by a clear distance and London is indexing just ahead of the total.

Trends in the value of spending: Spend, according to IPS, was slow from long haul markets in particular in the first half of 2024, driven in part by a decline in length of stay. The decline in spend was seen in IPS across all journey purposes and many markets (in some cases following unusually high spend per visit in 2023). The fast recovery of VFR trips has pushed down average spend per visit. There have been price pressures in the sector as tourism prices in the UK have risen sharply, and at a faster rate than overall inflation in the economy. Sterling rose 4% against the Euro from 2019 - 2024 (although there was no change vs the US dollar during this time), further increasing costs for some visitors. Looking forward, it is assumed that spend per visit will broadly track inflation within markets and trip types, with a small downgrade applied to long haul visits based on the assumption that length of stay is still slightly elevated and will continue to return to closer to pre-COVID levels, as has been seen for Europe. It is otherwise assumed that the recent fall in spend per visit will not persist. IPS spend can be volatile so there is on balance an upside risk that a weak year could be followed by above-trend growth.

Economic context: The global economy is forecast to grow slightly faster in 2025 than in 2024, although this varies by market (in the US a slightly lower rate of growth is forecast in 2025 than 2024; in the EU, growth forecast to increase from a low pace in 2024). This is the central forecast and there are plausible outcomes and risks either side, although the balance of risks is judged to lie to the downside given the potential for trade disruption. At time of writing inflation in 2025 of 3.0% was forecast.

Competitive context: After recovering from COVID slower than many European rivals, the UK looks to have regained share in 2024. However, forecasts suggest that looking forwards the UK is likely to lose competitive share both within Europe and globally. If inbound tourism to the UK was to grow at the same pace as forecasts are currently indicating for Western Europe, the value of inbound spending would be worth an additional £4.4 billion per year by 2030 to the UK economy.

Risks and assumptions: In addition to economic factors, there are also non-economic downside risks (political, security, epidemiological) as well as the risk of a greater than expected reaction to ETAs. It has been assumed that ETAs will not have a measurable impact for long-haul markets, as it is a very small proportion of total trip spend. It is assumed to have a small negative impact for Europe, as the proportion of trip spend would be larger, and the non-financial impact could be greater in markets where, on average, perceptions of welcome are lower, and other requirements (e.g. passports) recently tightened. A more substantial impact from ETAs would be a downside risk. A short term risk is that at time of writing flight bookings so far look somewhat soft for February onwards; it is assumed these will pick up from current pace, as the maturity for the shoulder and peak seasons is still low. An upside risk is that wider international tourism generally could grow at a healthy pace; there is potential here, as tourism volumes globally still remain below pre-COVID levels and even in Europe are only slightly ahead, despite real consumer spending having recovered further. Indeterminate risks include climatic (adverse weather; or UK as a more attractive proposition in summer), reputational factors, performance of competitors; also considerable uncertainty about the UK economy, e.g. inflation and exchange rates, and the global economy. On balance risks to the 2025 forecast are judged to be to the downside.

We will review our forecast in mid-year following publication of the final official inbound data for 2024 by the Office for National Statistics.

Related resources

For broader insights on inbound travellers please refer to our recent MIDAS research.

Find out more about the International Passenger Survey (IPS).