Pricing and charging

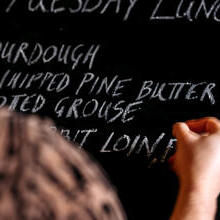

Photo by: VisitBritain/Stuart Harper

Location: Edinburgh, Scotland

Disclaimer

Disclaimer: While every effort has been made to ensure the accuracy of the information contained in the Pink Book, we regret that we cannot be responsible for any errors. The Pink Book contains general information about laws applicable to your business. The information is not advice and should not be treated as such. Read our full disclaimer.

Key facts

It is a criminal offence for businesses to provide customers with misleading information on the prices charged for services or goods.

It is an offence not to do everything reasonably possible to correct a price indication that has subsequently become misleading, if it is reasonable to assume that customers will still be relying on the original price information.

Prices must include VAT if you are VAT registered.

You cannot charge customers extra for paying by credit/debit card.

Price statements

Does this apply to me?

Almost certainly yes: the Consumer Protection from Unfair Trading Regulations 2008 covers all statements you make regarding the provision of products or services.

The regulations will normally apply to all businesses, regardless of whether the price is:

- Stated in an advertisement, a brochure, a leaflet or online;

- Given in an email or text message;

- Given by letter or over the telephone.

What does the legislation require?

It is a criminal offence for you to give customers misleading information on the prices charged for services or goods.

It is also an offence not to do everything reasonably possible to correct pricing information that has subsequently become misleading, if it is reasonable to assume that customers will still be relying on the original price information.

Good practice

The Chartered Trading Standards Institute’s Business Companion website contains a series of quick guides and in-depth publications on all aspects of trading standards. Included on the site is a good practice guide on how to comply with the Consumer Protection from Unfair Trading Regulations. It also produces information specifically related to the pricing of goods and services, called Guidance for Traders on Pricing Practices. This gives practical guidance on how to avoid giving misleading prices. Compliance with the guide, while not an absolute defence, will assist you in showing that you have not committed an offence under the act.

One important point to note is that you are not allowed to separate out non-optional extras (such as a cover charge) from your headline price. If there is a non-variable charge that a customer cannot avoid paying, then this must be included in the headline price.

Where non-optional charges vary, you should give clear information about the charging structure at the outset to enable customers to easily calculate the total cost before agreeing to a purchase.

All prices given to customers should include VAT. The message is that customers should not get any surprises when it comes to paying the bill.

Displaying prices on your premises

The Consumer Protection from Unfair Trading Regulations 2008 require you to be open and honest in your pricing, and not to mislead or leave out information that could affect the purchasing decision of your customers (see the Unfair trading practices section for further information).

While there is no specific regulatory requirement regarding the display of prices in reception, it is recommended guidance that you do so in order to fulfil your obligations under the regulations. This price list should be in a prominent position and be easy to read. It is suggested that the price list should include:

For accommodation businesses:

- The cost of a bedroom for one person (for example £75 per night) if all the rooms are the same price, or the lowest and highest rates (for example £70-95 per night) if there is a range of prices.

- The price of a bedroom for two people.

- The price of any other type of bedroom.

- Whether or not accommodation prices are inclusive of breakfast or other meals and services.

For attractions:

- The price of admission (for both adults and children).

- The price of admission for groups.

- Whether the price includes admission to all exhibitions/rides/activities.

- The price of components that are sold separately.

All prices must include VAT (if you are VAT registered) and any compulsory service charge. You must make it clear if meals are included in the price.

Further information on displaying prices is available from the Chartered Trading Standards Institute.

The Consumer Protection (Amendment) Regulations 2014 give consumers private remedies where a trader has committed a misleading or aggressive practice under the 2008 regulations. Under these regulations, consumers have simple, standardised recourse against traders who have misled or intimidated them into entering a contract or making a payment.

Importantly, they do not need to demonstrate any loss, or show that you have acted dishonestly, recklessly or even negligently. If the trader’s actions were misleading or aggressive, then the remedies apply.

Under the regulations there are three remedies:

1. Unwind a contract and get their money back

The right to unwind allows the consumer to undo the transaction that they entered into, restoring the consumer to the position he or she was in before entering the contract or making the payment. This must be done within 90 days of the start of the service being provided (that is, when they arrive at the property rather than when the booking was made), and it must be possible to reject the service (so this must be done before the booking ends).

2. Receive a discount on the price paid

The right to a discount applies where the right to unwind has been lost, whether due to delay (with a claim made more than 90 days after the relevant day), or because the goods or services have been fully consumed.

For goods or services that cost £5,000 or less, consumers have a right to a fixed percentage discount on the price. There are four pre-set bands of discount which can apply, depending on the severity of the misleading or aggressive practice:

(1) 25% if it is more than minor;

(2) 50% if it is significant;

(3) 75% if it is serious;

(4) 100% (full price) if it is very serious.

3. Claim damages for detriment caused

Consumers can claim damages if they have suffered losses that exceed the price paid for the relevant goods or service. Damages can cover distress and inconvenience, as well as losses suffered by the consumer because of the contractor payment they made as a result of the misleading or aggressive practice.

These damages can only be claimed upon proof of actual loss, or distress and inconvenience. In accordance with general principles, only reasonably foreseeable losses are covered.

Under the regulations, a defence can show that the misleading or aggressive practice happened as a result of a mistake or other cause beyond your control, and that you took all reasonable precautions to avoid the misleading or aggressive practise from occurring.

For more information, see the Gov.uk publication: Misleading and Aggressive Commercial Practices: New Private Rights for Consumers.

Bonds/card payments in case of damage

The practice of accommodation businesses taking bonds (or damage deposits) is separate from taking a deposit on the payment for the booking.

This bond is protection against damages incurred while the guest is staying in the property, but is becoming increasingly uncommon as businesses tend to retain customers’ credit or debit card details in case of damage. If you wish to either charge a bond or to retain customers’ card details so that you can recoup any damages, you must notify customers of this prior to the booking being agreed (while this can be done verbally, it is far better to do it in writing in case there is any dispute).

It is important to note that you are only able to retain money from the bond, or charge a customers’ card, if the damage has resulted from a deliberate act (such as kicking walls) or negligence (actions whereby it was reasonably foreseeable that damage would occur). You are not able to charge for damage that results from general ‘wear and tear’, for example marks on floors, an electrical item failing or a cup breaking during washing-up.

To protect against disputes, it is good practice to show a customer around a property so that any pre-existing damage can be recognised and agreed (as car hire companies do), and to get photographic evidence of any damage, in order to support your actions if the customer or their credit card company queries the charge. Also, three quotes should be gained on any repairs to show that the amount being charged is justified.

The requirement for guests to provide a bond or pay for damages must be applied in a fair and consistent manner that does not breach anti-discrimination law. That is, the requirement should be imposed on all guests and cannot just be imposed on the basis of race, disability, sexual orientation, age or gender. For example, you cannot require a bond from a group of young male customers if you do not require it from other groups of customers.

Credit and debit card charges

It is illegal to make any additional charge where payments are made using debit, credit or charge cards, such as American Express and electronic forms of payment such as PayPal.

In essence, this means that the price you advertise a product for must be the price that the customer pays at the end of the booking process. However, you are allowed to increase the headline cost of your product to compensate for not being able to charge the card fees if you wish.

The law also only applies to purchases made by personal consumers and not to purchases made by businesses. So, if your customer is a business (for example a company booking rooms for an away day or to use an attraction for an event) then you are allowed to charge a card-processing fee, provided that it is no more than the cost to you of processing the transaction.

However, in this situation it is important to note that a customer must be using a business card for you to charge a fee. You cannot charge a card-processing fee if the customer is using their personal card, regardless of whether they will reclaim the cost as a business expense later.

Further guidance

Guidance on pricing practices

Business Companion provides free, impartial legal guidance for businesses on Trading Standards law.

Your local Trading Standards office

Check you are trading legally by contacting your local Trading Standards office.