Inbound markets

Introduction

Please note, 2024 data from the International Passenger Survey is badged as ‘official statistics in development’ and estimates are subject to future change as further improvements to the methodology are introduced. The ONS are not endorsing comparisons with previous years. See the ONS website for more information.

Introduction

Get the latest information on the value and behaviour of Britain’s overseas visitors.

Use the dashboard to view headline visits, nights and spend for our key inbound markets – and for more detailed data and insights, click on the country profiles below.

These statistics are sourced from the International Passenger Survey, run by the Office for National Statistics.

Data shown for 2024 is at the GB level, whereas data for all previous years is at the UK level. For the 2024 UK figures, please see the annual page.

For further information, please get in touch.

Inbound market data

Photo by: VisitBritain/VisitEngland

Photo by: VisitBritain/VisitEngland

Photo by: VisitBritain/VisitEngland

Newsletter signup

The latest news, straight to your inbox

Stay informed: register for newsletters compiled by our specialist teams – for UK businesses, the international travel trade and media professionals.

Stay informed: register for newsletters compiled by our specialist teams – for UK businesses, the international travel trade and media professionals.

Explore our curated information for...

Everything you need to inspire your clients. Discover new products, experiences and itinerary ideas – plus useful resources and the latest market insights.

Reach new customers and increase your profitability. Drive sales with our tools, events and training, find out about quality assessment and get expert guidance from the England Business Advice Hub.

Build sustainable and valuable growth. Learn about England’s new destination management structure, find expert advice, and boost your proposition with our training and toolkits.

Access resources for business events to support your business development and event strategy. Discover England, Scotland and Wales' business event offering for your next conference, incentive, exhibition or event.

Discover our media centres, image and video library and latest press releases, plus contacts for our corporate and consumer press teams.

Studying tourism at school, college or university? We’ve gathered essential resources and data for students of tourism, plus information about our internships.

Everything you need to inspire your clients. Discover new products, experiences and itinerary ideas – plus useful resources and the latest market insights.

![BELFAST MUSIC TOURS - Exchange Placwe group 2 facing BB]()

Reach new customers and increase your profitability. Drive sales with our tools, events and training, find out about quality assessment and get expert guidance from the England Business Advice Hub.

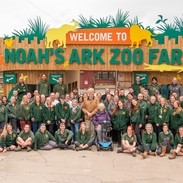

![A sign which reads "Welcome to Noah's Ark Zoo Farm" with various staff members standing in front wearing matching branded tops. Noahs Ark Zoo Farm - Gold award winner for the Accessible and Inclusive Tourism Award at the VisitEngland Awards for Excellence 2023.]()

Build sustainable and valuable growth. Learn about England’s new destination management structure, find expert advice, and boost your proposition with our training and toolkits.

![An aerial view of the grounds surrounding Blenheim Palace, an eighteenth-century country house, surrounded by gardens, trees and a lake crossed by a bridge to reach the front of the house. Blenheim Palace - Silver award winner for the Large Visitor Attraction of the Year at the VisitEngland Awards for Excellence 2023.]()

Access resources for business events to support your business development and event strategy. Discover England, Scotland and Wales' business event offering for your next conference, incentive, exhibition or event.

![Bell's Bridge and the SEC Armadillo by the river Clyde in Glasgow, at sunrise.]()

Discover our media centres, image and video library and latest press releases, plus contacts for our corporate and consumer press teams.

![Two men standing in front of street art, dancing]()

Studying tourism at school, college or university? We’ve gathered essential resources and data for students of tourism, plus information about our internships.

![VB34184455]()